Willingness to Pay

The firm with the right strategy always wins!

Understanding Willingness to Pay (WTP) in Consumer Goods and Services

In the world of consumer goods and services, understanding your customers’ willingness to pay (WTP) is crucial for setting the right price for your products. This concept goes beyond basic economics; it directly influences your brand’s profitability and market positioning.

1. What is Willingness to Pay (WTP)?

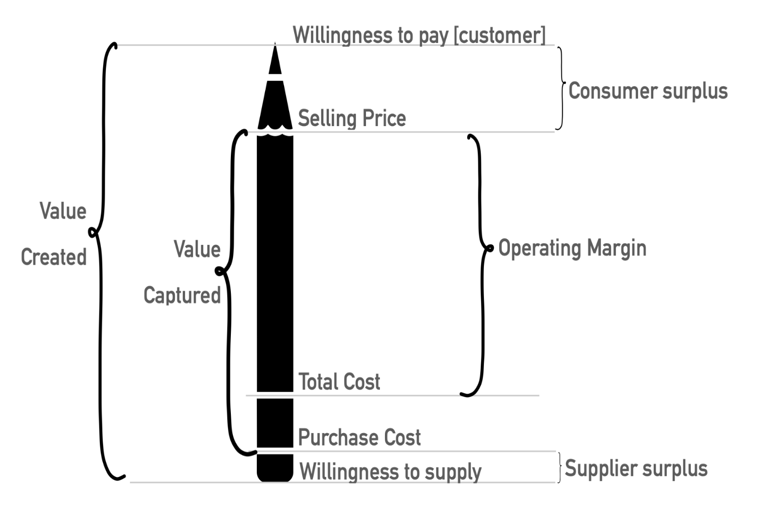

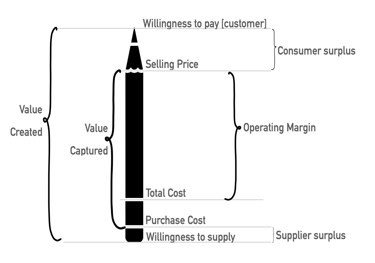

Willingness to pay (WTP) refers to the maximum price a customer is willing to pay for a product or service. This figure represents the perceived value of the product to the consumer, influenced by factors such as quality, brand reputation, and individual preferences. Understanding WTP helps businesses gauge how much consumers value their offerings.

2. Why is WTP Important in Product Pricing?

Properly gauging WTP is essential for several reasons:

Optimizing Revenue

Setting a price too high can alienate potential customers, while setting it too low can result in lost revenue opportunities.Market Positioning

Price is a key indicator of a product’s market position. Understanding WTP ensures that your pricing aligns with your brand’s positioning strategy.Customer Satisfaction

Prices that reflect consumers’ WTP can lead to higher satisfaction and loyalty, as customers feel they are receiving fair value.

5. What is Consumer Surplus?

Consumer surplus is the difference between what consumers are willing to pay for a product and what they actually pay. It represents the additional benefit or value that consumers receive when they pay less than their maximum WTP.

For example, if a customer is willing to pay $100 for a product but the actual price is $80, the consumer surplus is $20. Understanding consumer surplus helps businesses:

Gauge Customer Value:

It provides insights into how much value customers perceive in your product beyond its price.Identify Pricing Opportunities:

Recognizing high consumer surplus can indicate opportunities for price adjustments or premium offerings.Improve Customer Satisfaction:

Ensuring some level of consumer surplus can enhance satisfaction and loyalty, as customers feel they are getting a good deal.

'WTP Minus Total Cost' is a key Strategic Variable

In strategic pricing, a crucial variable to consider is the difference between Willingness to Pay (WTP) and Total Cost. One one hand, WTP is the highest price a consumer is willing to pay for a product or service, reflecting the perceived value of the offering. On the other, Total Cost encompasses all the expenses incurred to produce and deliver the product, including manufacturing, marketing, distribution, and overhead costs. This difference between these two essentially represents the potential profit margin for a product or service and the pricing power of the brand. Understanding and optimizing this variable is key to a successful pricing strategy, in order to compete in a market with high degree of competition and substitutes.

Conclusion

Understanding and leveraging Willingness to Pay is vital for setting optimal prices for consumer goods and services. It ensures that prices align with consumer perceptions of value, enhances profitability and strengthens market positioning. By accurately measuring and strategically improving WTP, businesses can create pricing strategies that maximize revenue, customer satisfaction and beat competition rivalry.

The strategic variable of WTP minus Total Cost provides several critical insights:

Profitability Assessment

By calculating the difference between WTP and Total Cost, businesses can determine the maximum potential profit per unit. A higher margin indicates a more profitable product.Pricing Strategy

This variable helps in setting the right price point. A price too close to WTP maximizes revenue but may reduce sales volume, while a price too close to Total Cost risks insufficient profit margins.Value Proposition

The gap between WTP and Total Cost reflects the value delivered to the customer versus the cost incurred by the business. A wider gap suggests a strong value proposition and efficiency in cost management.Competitive Advantage

Understanding this variable can highlight areas where a business has a competitive edge, either through higher WTP due to superior value or lower Total Cost due to operational efficiencies.Investment Decisions

Businesses can use this metric to make informed decisions about product development, marketing investments, and cost management initiatives aimed at either increasing WTP or reducing Total Cost.

3. How Do We Measure Our Products' WTP?

Measuring WTP can be approached through various methods:

Surveys and Questionnaires:

Directly asking customers how much they are willing to pay for a product.Market Experiments:

Introducing the product at different price points in different markets to observe consumer reactions.Conjoint Analysis:

A statistical technique that helps understand how customers value different attributes of a product.Historical Sales Data:

Analyzing past sales to identify patterns in pricing and purchasing behavior.Competitive Analysis:

Reviewing competitors’ pricing strategies to infer potential WTP in your target market.